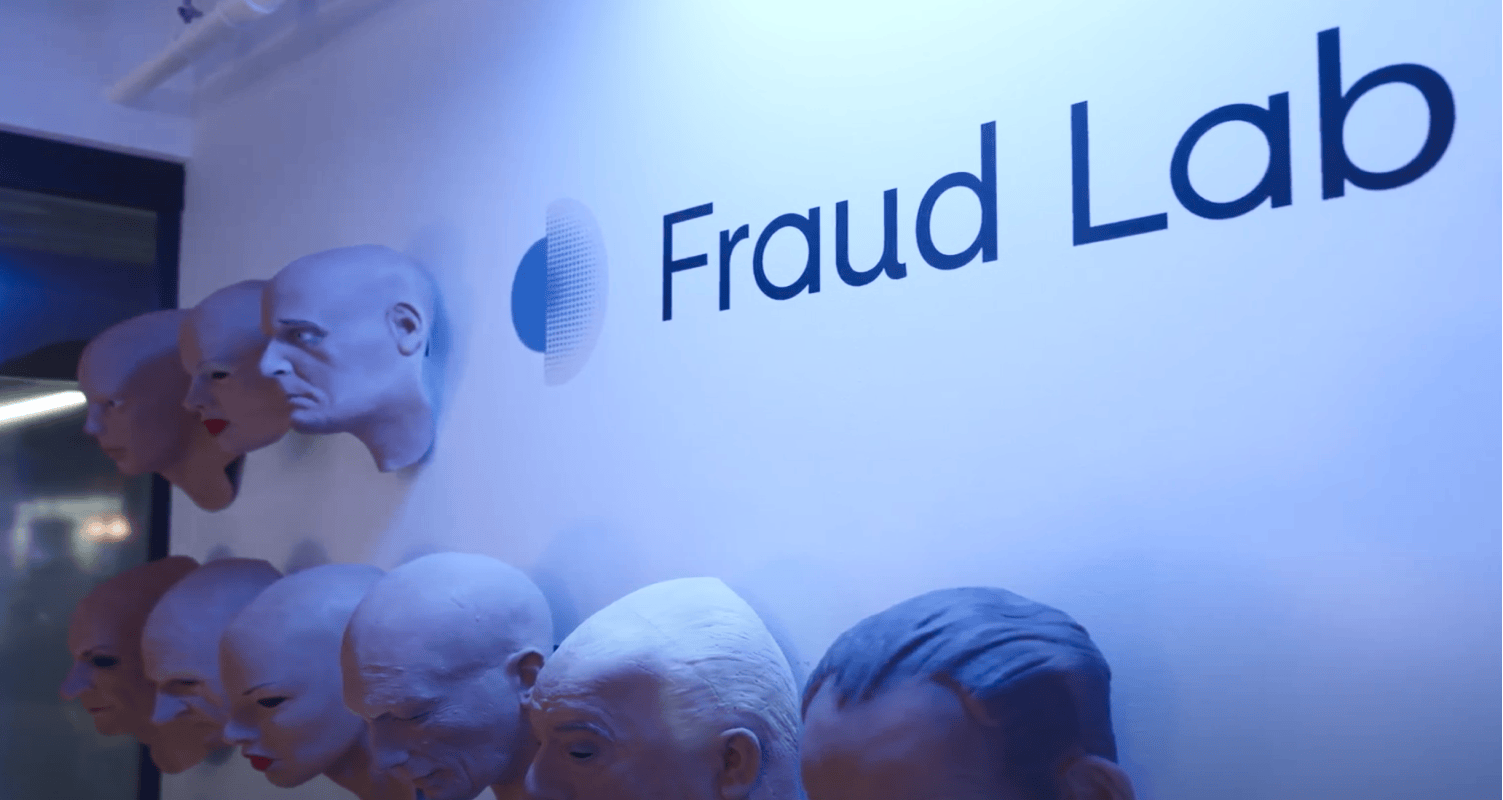

Welcome to the front lines of digital security, where innovation meets deception. In an era defined by sophisticated cyber threats and ever-evolving fraud, the importance of a vigilant and adaptive defense cannot be overstated. This is where the experts of Onfido’s Fraud Lab come into play.

Fraud Lab is not just a team — it’s a dynamic force committed to staying one step ahead in the ongoing battle against fraud. Using real-world data and in-house created synthetic samples, Fraud Lab identifies fraud patterns and trends, effectively training AI models to deliver fraud countermeasures. As technology advances, so do the tactics of fraudsters, demanding a proactive and ever-evolving approach to safeguarding identity verification and improving our product performance. Let’s take a closer look at the brilliant minds behind Fraud Lab and the value Fraud Lab generates for our customers.

Meet the fraud experts

Let’s go behind the scenes of Onfido’s Fraud Lab where we get to know the driving forces, Vincent Guillevic and Simon Horswell.

Meet Vincent Guillevic, Onfido’s Director of Product with over a decade of experience crafting innovative software solutions. Since 2016, Vincent has led a dedicated product design team at Onfido committed to user-centric experiences. A couple of years later, Vincent became a pivotal force in Fraud Lab initiatives. His creative vision and dedication contributed to the lab’s groundbreaking work, showcasing the first demo of dataset using a 3D rendering. As the Director of Product, he continues to champion seamless, secure, and scalable user experiences while combating fraud.

Simon Horswell is Onfido’s Fraud Specialist Senior Manager. His journey began in border control, where his passion for combating document fraud emerged during his first week of training. Over the years, he ascended the ranks, becoming a qualified Expert Witness at the National Document Fraud Unit and contributing significantly to the field of document examination. With over two decades of experience, Simon now leads a team of expert investigators within Fraud Lab, focusing on addressing the root causes of fraud, advising on potential vulnerabilities, and driving innovative solutions for identity verification.

Let’s start at the beginning — how did Fraud Lab come about? What is the purpose of Fraud Lab?

Fraud Lab began as a side project that evolved into a groundbreaking endeavor. Initially, it started with a simple idea: testing Onfido’s fraud capabilities by occasionally feeding a fraudulent document into the system. To make the testing more elaborate, the team trained an intern with some graphics skills to digitally alter documents. Vincent saw the potential to turn this basic testing into something bigger, realizing the impact it has on training machine learning to fight these emerging fraud trends faster and more accurately. The next step was scaling things up and automating the process. “We were told this was essentially a dead end,” Vincent shared. “The specific fraud examples were too sophisticated to reproduce at scale, and we had high ambitious goals of generating hundreds of thousands of samples. Despite this skepticism, we wanted to see how far we could go.” The first project was helping biometrics research, using hundreds of masks to help Onfido achieve iBeta Level 2 certification. Fast forward to the present, Fraud Lab can now replicate even the highest sophisticated fraud at scale, no matter if it’s a physical alteration of a document or a deepfake.

How does Fraud Lab differ from how fraud was detected 3 or even 5 years ago?

Over the past five years, machine learning has made remarkable progress, with synthetic data playing a crucial role in filling gaps in our datasets. Traditional methods often rely on historical patterns and reactive measures, responding to known fraud types. However, Fraud Lab enables us to take a more proactive approach. “By tailoring our systems’ training in real time with our fake samples production and training, we can test our systems against threats we are yet to see in real life,'' highlights Simon. “This way, we already have a defense for them before they emerge.” Also, as Fraud Lab is getting more precise in detecting fraud signals, we can reduce the number of false positive results as well. Essentially, it means more genuine customers pass through successfully while more bad actors get stopped.

When it comes to security, what concerns do you hear in the community that Fraud Lab could solve?

With the ongoing discussion on security concerns, the most prominent one in the community is around the advancements of generative AI. While generative AI is driving productivity and efficiency, it also is a double-edged sword, serving as a tool for fraudsters to automate sophisticated attacks around the clock. These AI-powered tools are leading to the rise of deepfakes, email phishing, and voice spoofing, creating significant challenges discerning genuine from fraudulent content. Furthermore, as AI-powered tools become more accessible, the entry barriers to committing fraud at scale become much lower. “Fraudsters are embracing these tools and organizing quickly,” Simon cautions. “Being able to react more quickly, or even preemptively, is vital moving forward. This is exactly why we created Fraud Lab.”

What challenges did the team face in developing Fraud Lab?

Creating Fraud Lab brought about a set of challenges for the team, with the main one being understanding fraudsters. To effectively replicate fraud and provide the necessary input for our machine learning models, we need to delve deep into fraudsters’ archetypes, motivations, and skill sets. However, this pursuit is particularly complex as fraudsters are a moving target, becoming more organized and attacking at scale. “Fraudsters’ strategies involve systematically testing defenses with a few trial fraudulent documents, waiting to exploit identified gaps, and then striking at an amplified scale,” Vincent explained. “The quick pace at which fraudsters submit documents and then return to launch attacks creates an urgent need for swift defensive preparation. Orchestrated by criminal organizations, these attacks could potentially scale to hundreds of millions or even billions.” Understanding these fraudsters is not just about keeping pace with fraudsters’ tactics — it’s about taking proactive steps to prevent these attacks from escalating beyond control.

Another significant challenge we faced when developing Fraud Lab revolved around the lack of granularity in qualifying attacks. Our technology needs to be precise enough to reproduce and flag fraudulent attempts accurately. Typically, models are trained solely on authentic documents. However, fraudsters have become more and more skilled at creating fraudulent documents that closely resemble authentic documents. To counter this, our approach underwent a drastic shift. We focused our efforts on training our models not only to recognise genuine documents but also to identify these counterfeit attempts. This capability to spot and flag fraudulent documents within the training data significantly contributes to a more robust and accurate fraud detection system.

Where does Fraud Lab sit within the digital identity workflow?

Fraud Lab plays a critical role in shaping and strengthening our digital identity verification workflow. It serves as the driving force behind our machine learning, enabling us to scale our capabilities for better fraud prevention. By comprehensively analyzing fraudsters’ behaviors, archetypes, and strategies, our models can generate vital datasets needed to fuel machine learning models. These datasets enable our solutions to not only discern genuine documents but also swiftly identify and flag fraud within the verification process.

With Fraud Lab, we can ensure that our identity verification system remains dynamic and adaptive, constantly evolving to anticipate and counter emerging fraud threats.

What was the most shocking fraud trend or result you found while working in the Fraud Lab?

In Fraud Lab, the most startling trend we’ve observed is the rapid rise of deepfake fraud. Deepfakes refer to digitally manipulated videos or images, where a person’s face is altered to appear as someone else. Fraud Lab came across their first deepfake applicant in 2021. Now, in just this past year, deepfakes have skyrocketed by an astounding 31-fold. What’s alarming is the ease a single fraudster alone can flood platforms with hundreds of these deceptive images or videos — all in a short period of time.

In response to these emerging fraud trends including deepfakes, we intensified our focus — the outcome was extraordinary. Fraud Lab meticulously crafted 250,000 data sets tailored for Onfido Motion, our fully automated biometric liveness solution. This substantial dataset went far beyond our estimates, contributing to Motion’s advancement. It’s been proven to deliver a 10X anti-spoofing performance improvement with 95% of checks returned in less than 15 seconds.

Take a deep dive into the latest research behind fraud trends and prevention in our 2024 Identity Fraud Report.