Millennials and Generation Z (Gen Z) are a big part of FinTech’s core market. And this market is growing. Catering to this generation is something most, if not all, FinTechs are concerned about. Gen Z in particular represents a steadily growing market. In 2018 they had around $143 billion of spending power, and look set to become the largest generation of consumers in 2020. If FinTechs fail to understand and engage millennials and Gen Z, they won’t survive.

Millennials and Gen Z are terms used to define an age group between 24 and 40, and 8 and 23 years old, respectively. Given the vast differences in age, we can’t assume that what appeals to one group will automatically appeal to the other. But there are some common themes across the generations that FinTechs should bear in mind when looking to engage them.

What relationship do they have with technology?

Both millennials and Gen Z are heavily invested in technology. Millennials grew up as technology developed, and adopted it as part of their lives. They’ll still remember when mobiles with keypads and dial-up internet were the latest in groundbreaking technology, but are used to adapting to new, innovative advances.

Gen Z, on the other hand, have never known life without a smartphone or the internet. They didn’t just grow up with technology, they were born into it. Even the oldest members of Gen Z are younger than Amazon.

What are their attitudes to banking and finance?

The attitude of millennials and Gen Z towards their finances have been influenced by the economic climates they experienced growing up. Many millennials entered the job market and were building up their finances shortly after the economic recession.

Gen Z grew up during the recession. They watched the post-2008 fallout unfold as children, and may well remember the impact it had on their parents and family's lifestyle. As a result, they enter adulthood with greater financial anxieties. In a survey, 81% said money was a major stress, and 33% see personal debt as a main source of anxiety.

This economic overhang has made both generations more spending conscious than their parents or grandparents. Both are interested in savings and financial management. Gen Z, in particular, make practical financial decisions.

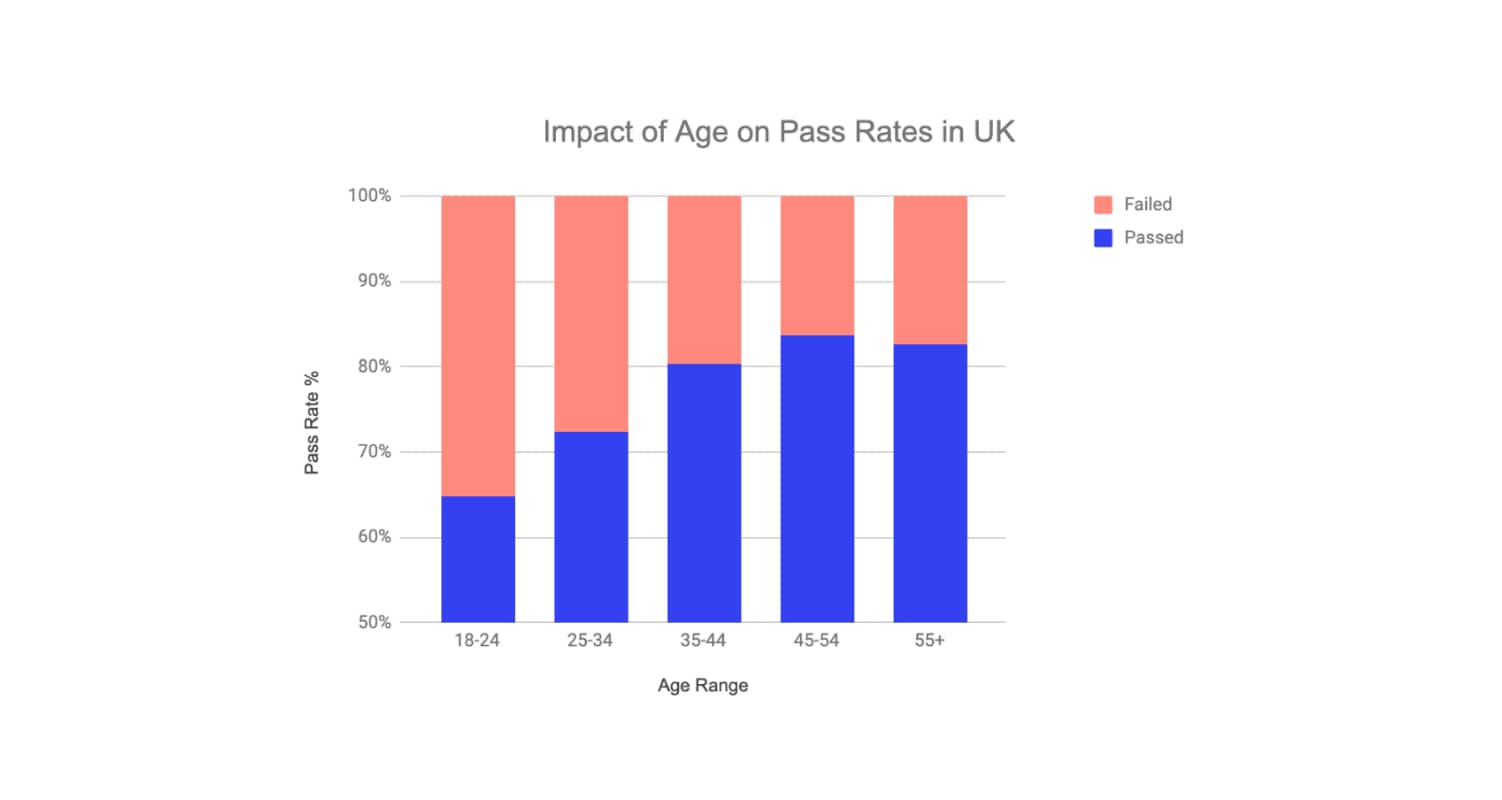

However, the traditional ways of accessing financial services often exclude the younger generations. To verify a customer’s identity, banks have traditionally relied on credit scores and database checks. With their minimal credit history, younger generations can return poorer credit scores, and may be denied the financial services that they want and need.

As a result, younger generations, and particularly those below 18 years old, are largely unbanked and less supported by the financial system. But in time, it’s this generation that will make up a growing majority of the market.

When it comes to opening a bank account, however, 61% of Gen Z choose the same bank as their parents. But while they are likely to take parental advice on board when choosing a bank, but this doesn’t mean they are choosing the one that best services their needs.

After all, younger generations are more likely to conduct financial business with a technology company than any other generation. 44% of Gen Z and 37% of millennials would choose to conduct financial relations with a technology company, which are the highest percentages when compared to other age categories. Similarly, many millennials have a colder relationship with traditional banks than older generations. According to a World Economic Forum report, only 28% suggested they would prefer to use them.

So it would appear that there is an appetite among millennials and Gen Z for alternatives to traditional financial services models. As both generations are digital natives, it makes sense that they are more open and willing to accept digital and technology-based finances.

But FinTechs will still need to go some way to engage these generations. After all, among members of Gen Z who have opened a bank account, 54% say they don’t plan on opening another account, no matter the incentive.

What can FinTechs do to engage millennials and Gen Z?

FinTechs can’t take for granted that their services are marketable and attractive to younger generations, just because they are a tech-savvy alternative to traditional models.

Consumer technology is in a phase of fast change and innovation. To ensure they remain part of this, FinTechs need to understand the younger generations. And not only understand them, but offer products and services that actually help young people reach their goals. So what steps can FinTechs take?

1. Be honest and open about your products, and do right by your customers

According to Salesforce Research, 71% of millennials say they trust companies, versus 63% of Gen Z. And only 55% of millennials are comfortable with how companies use their personal information, falling to only 44% of Gen Z.

This research suggests that there is an inherent distrust among younger generations around how companies treat consumers. Especially when it comes to their data.

Millennials and Gen Z expect the companies they do business with to behave with integrity. Given a choice between two banks, 86% of students would choose the one that’s more ethically focused, even if the incentive is lower.

FinTechs should take this into account if they want to win over the younger generations. Incentives aren’t always the key to winning customers in this space, rather the way the company does business and treats its customers.

2. Leverage technology to support customers’ goals

As we’ve discussed, millennials and Gen Z are more savings-focused and financially aware than previous generations. They want practical technology that can help them achieve their goals—this could involve building up savings, making investments, or becoming financially independent.

FinTechs should design their services with these points in mind. Bank accounts can have built-in savings devices, or features that help users avoid debt. Investing can be made more straightforward with in-app banking tools. Younger generations want to understand and be in control of their finances. So companies that take the time to educate, as well as provide a service, are likely to succeed. For example, Monzo recently launched a free in-app credit check.

3. Create streamlined digital experiences

Younger generations are digital natives. They are more open to technology playing a part in their financial relations. But they expect digital experiences to be straightforward, easy to use, and often mobile-first. To engage this generation, FinTechs will need to provide seamless customer journeys, backed up with personal customer support when it’s required.

When it comes to opening a bank or other financial services account, we’ve already seen that credit database checks don’t provide the best user experience for customers. They’re slow, and often won’t pass younger generations with small credit histories.

But there are alternative methods to customer verification which will help companies streamline digital experiences. And open up their services to the younger, underbanked generations.

Find out how customers of all ages really feel about digital identity verification.