A digital identity is a collection of information about a person that exists online. When this information is grouped together, it can provide a digital representation of an individual to help them access services and goods once a business has verified the identity of the customer.

As the world moved online more rapidly than ever before in the last years, fraudsters have also become more sophisticated, seeing these increasing digital opportunities. Digital identity use has become more prevalent and more important, and so has digital identity verification.

Digital identity types

There are different ways to verify digital identity, ranging from document verification, biometric verification to database checks. Once a user has verified their identity, this unlocks access to online services like banking, investing, gaming and travel.

People can identify themselves online using different types of digital identity information. They can upload or take a picture of their official ID. Or they can verify themselves with biometric scans such as facial recognition, fingerprints or voice. They can also submit personal identifying information (PII) about themselves, to be verified against database checks.

Digital identity examples

A digital identity, or digital ID, is a representation of a person’s real self, online. Just like in the real world, there are many unique identifiers that can make up a digital identity. These include:

- Personal information, like name and date of birth

- Email addresses

- Usernames and passwords

- Social Security numbers

- Passport numbers

These unique identifiers make it possible for businesses to be able to confirm who tehy are transacting with behind the screen.

Why is digital identity important?

There are countless moments in life where someone must prove their identity: besides opening bank accounts and signing up for services, proof of identity must be shown for purchasing age-restricted products, enrolling in universities, or to prove eligibility for driving or renting. As more businesses move online, the use of digital identities is also increasing.

Benefits of digital identity

Digital identity offers convenience to traditional methods. This includes its location-independence: you can prove your identity digitally from wherever you happen to be, instead of physically going to a branch or location.

Another benefit of digital identity is the increased security and fraud detection that can be performed digitally. As technology improves, digitally verifying identity has become more secure. And, using a digital identity is also faster. Automation by AI-powered digital identity verification reduces the need for manual verification, freeing up internal teams, and giving users a faster experience. The security, ease and speed of digital identity can reduce drop-off and increase customer acquisition while protecting against fraud.

Download the Guide to Digital Identity Verification to discover how the identity verification landscape has shifted and where the future of onboarding is heading.

Understanding the impact of digital identity

Think back to 20 years ago: the concept of a digital identity was fairly unheard of. Then cue the invention of the internet. When once it was normal to head to your local bank branch to open an account, or approve a transaction, many of these operations moved online.

That caused a much greater need for identification in cyberspace. It also presented a new modern challenge — how to accurately determine the identity of a person in cyberspace. In other words, how to tell if someone is who they say they are, online?

Fast forward twenty years and a digital-first way of life is now widely accepted. Digital identities now form the foundation of many online interactions, transactions and activities. And technology has gotten much better at verifying people’s identities online, from document and biometric checks to fraud detection.

Common uses for digital identity

Digital identity can be used to verify identity across many cases. Here are some common uses of digital identity:

Opening accounts

Verifying identity is almost a guaranteed necessity to open an account online for a bank or other financial services. Banks now use digital identity verification technology to allow new customers to open an account by taking a picture of their genuine ID, and then a facial recognition scan to make sure there’s a real person who owns the ID presenting it.

Age verification

Many services and purchases require a customer to be a certain age, for example: driving, renting, purchasing alcohol or other restricted goods, or gambling. Using digital identity for age verification protects a business by making sure they don’t violate laws by transacting with restricted customers.

High-risk transactions

Customers who are moving a large amount of money or other high-stakes transactions may need to re-verify or authenticate their digital identity.

How to verify digital identity

Digital identity is made up of many things. So businesses have a choice of what to use to verify the identity of their customers online. These methods provide different levels of assurance in determining — is this person who they’re claiming to be online? Does their digital identity match who they are in real life?

Verifying one element of a digital identity in isolation is going to provide a low level of assurance of that person’s real identity. For example usernames and passwords alone are not enough to verify who a person is.

The best approach to verifying digital identity layers a range of checks. These could include a combination of the following:

- ID Record Check (database checks): A low friction approach for customers, background database checks validate user information against comprehensive databases, which can include voter registers, consumer, credit, and utility databases.

- Proof of Address Check: Establishing proof of address is a primary measure to meet many AML directives at the point of onboarding new customers.

- Document Verification: Whether it's due to regulatory mandates, susceptibility to fraud, or lack of coverage, database checks alone can't always satisfy assurance in a customer's identity. Document verification offers a higher level of confidence in a customer’s identity by verifying a legal document.

- Biometric Verification: Helps ensure that the person presenting an identity document is its genuine owner. Matching a customer’s facial biometrics to those on the identity document enhances security, meets compliance requirements and can facilitate biometric authentication in the future.

- Watchlist Check: Screen users at onboarding and continue to monitor them beyond that against multiple sanctions, politically exposed persons (PEPs), and other data sources.

Digital identity for financial services

In a digital world where consumers value convenience and instant access, a physical-first banking experience won’t cut it. Customers now expect online banking services as a given.

But digitizing banking experiences isn’t as simple as moving money management services online. For financial services, digital means new challenges, whether that’s combatting online fraud, maintaining user privacy or reducing friction in the customer experience.

Fraudsters can easily access leaked SSNs and personal information on the dark web and use information like this to create synthetic identities and set up fake accounts.

Plus, consumers need to have trust in the onboarding process. Up to 43% of customers will abandon account creation if they feel their data is not secure, the process is too invasive or onboarding takes too long. Customers will no longer accept long wait times to access financial services when identity verification can grant them access in minutes.

By making digital identity verification a central part of their digital strategies, banks can meet the demands of modern customers while simultaneously safeguarding the business and its customers.

How to navigate the digital identity landscape

Digital identity may be more convenient for the consumer. But verifying identity becomes much more difficult in the digital world than it is in the physical. In the real world, people present an identity document or another form of documentation, and the person reviewing can do a direct, in-person comparison.

There are far more security attributes to analyze on a physical document for example, than on an image of a document. And unless someone is a skilled fraudster, able to create a high-quality fake ID, it will become obvious quite quickly if they’re using an identity document that doesn’t belong to them.

It’s also far easier for fraudsters to launch multiple attacks in the digital world. They can hide behind a computer and attempt to brute force the system with hundreds of attempts until one manages to get through.

So when analyzing digital identity verification services, businesses need to take all these things into account. As well as asking the fundamental question — what value is this going to bring to my business?

What to look for in a digital identity verification service

A good partner can protect your business from fraud, help navigate regulatory compliance, and ensure a smooth, convenient experience fro your customers. Some things to look for in a digital identity verification provider are:

- Experience providing identity verification services to established businesses that meet KYC and AML requirements. For heavily regulated industries like financial services, they need an identity solution that helps them meet compliance requirements, without sacrificing the customer experience.

- Range of checks that support a business's expansion to multiple markets. Can the identity verification service scale with your business? Businesses should ensure any identity solution they opt for offers a range of checks, in addition to supporting global countries and document types. This will benefit them as they grow and adopt new cases, and expand into new markets.

- Able to accurately detect fraud. Any identity solution should be able to accurately detect and flag fraud. This will help prevent things like document fraud and synthetic identity fraud.

- Product roadmap that takes into account market trends. New technologies like NFC are constantly emerging and can offer several benefits. For example, they can not only build that assurance in a customer's identity but also make the process easier for the customer. Fraudsters are also always developing new ways to attack businesses. So any digital identity solution should be able to innovate and keep pace with this.

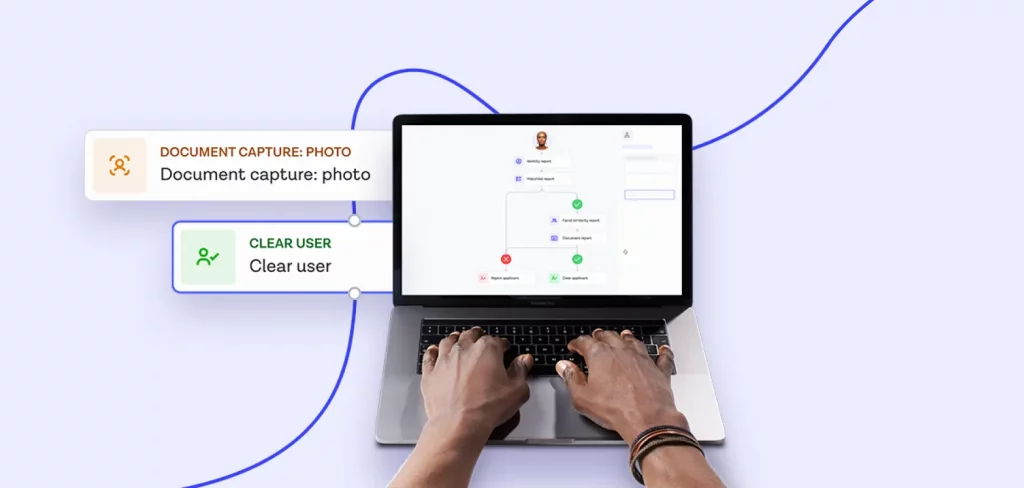

Onfido makes digital identity simple. The Onfido Real Identity Platform allows businesses to tailor identity verification methods to individual needs in a no-code orchestration layer, combining document and biometric verification, data sources, and passive fraud signals. Onfido Atlas™ AI powers the platform's fully-automated, end-to-end identity verification. Developed in-house for over 10 years, it’s how Onfido ensures its analysis is fair, fast and accurate.

Onboard new users faster and efficiently with an end-to-end identity verification solution.