We need to talk about fraud. Or more specifically, why businesses need to implement smarter fraud detection processes.

This shift to always-on, digital-first access is a huge benefit to consumers everywhere — but also poses a risk to service providers who aren’t leveraging robust fraud defenses and identity verification.

At the same time, the fraud landscape is changing. We’re entering a new era where generative AI is becoming a part of our collective daily lives. And that includes fraudsters. Digital fraud such as deepfakes is on the rise, and with new fraud frontiers must come more robust defence.

What is fraud detection?

Fraud detection is the process of identifying and preventing fraudsters. Since the digital revolution, identity fraud has evolved. As fraudsters can mount attacks and share techniques more quickly than ever, it’s becoming one of the fastest-growing crimes.

Financial institutions are one of the industries at most risk from fraud. Although in recent years fraudsters have also broadened their reach to professional services, gaming, retail and other industries.

Today, businesses are using artificial intelligence (AI) and data analysis to detect fraud. Specialist AI is trained to detect anomalies across identity documents during document verification and signs of biometric fraud during biometric verification. A successful fraud detection solution should incorporate several different layers of protection. For example, combining data signals with document and biometric verification.

Business challenges when detecting fraud

During any interaction with a customer, fraud poses a threat. At the start of a business-customer interaction, businesses need to be able to tell the difference between ‘good’ genuine customers and ‘bad’ fraudulent customers. For regulated businesses, this is mandated by compliance to help prevent financial crime. But beyond that, detecting fraud helps to protect a business’s bottom line while keeping genuine customers safe.

Challenge 1: Businesses need to be able to tell the difference between genuine and fraudulent customers, online, at that first point of interaction.

Unfortunately for businesses, fraud doesn’t stand still. Fraudsters are constantly innovating to find new ways around defenses. Businesses need to be able to protect against a range of attack vectors. Not just the ones they saw yesterday and today, but the ones they’ll see tomorrow

Challenge 2: Businesses need to look ahead when it comes to fraud detection tools. They need to prepare for future attack vectors as well as prevent the ones they see today.

Finally, businesses are serving more customers online than ever before. But manual approaches often slow down identification — that process of figuring out who the ‘good’ customers are versus the ‘bad’. Slow, clunky verification will only deter genuine customers and up to 43% of end-users will abandon a sign-up process if it doesn’t meet their expectations. There needs to be the right balance between achieving a good level of security while maintaining a seamless user experience.

Challenge 3: At the same time as detecting fraud, businesses need to optimize the sign-up process for genuine users, striking the right balance between security and UX.

So, in the face of these challenges, how do businesses detect fraud while simultaneously growing their business? Below we run through three steps to help drive success when detecting fraud.

How do you detect fraud?

Step 1: Start detecting fraud at onboarding

To detect fraud, businesses need to start at onboarding. It’s the first interaction a business has with a customer, and the first opportunity businesses have to identify fraudsters. Spotting and preventing fraudsters early helps minimize any damage later on in that customer journey.

Think about it in a real-world scenario. If a burglar wants to access your house to steal your belongings, you want the alarm to go off before they even get inside. Once they’re inside, they can do far more damage and are much more likely to successfully steal something. It works the same with fraud. Fraudsters can do more harm once they are through the business's front door.

Sign-up is also when businesses gather the most information about a customer. Piecing together all this information can help give a clearer picture of fraudulent users, and help stop more types of fraud at onboarding than at any other point in the customer lifecycle.

Step 2: Leverage fraud detection tools that use AI

Artificial intelligence (AI) is your new best friend when it comes to fraud detection software. Why? AI is lightning-fast and can process huge amounts of data more quickly (and more accurately) than humans.

Most fraud detection software that uses AI is trained using machine learning. Machine learning is a subset of AI that is able to learn and adapt without following explicit instructions, by using algorithms that can make assumptions based on patterns in data.

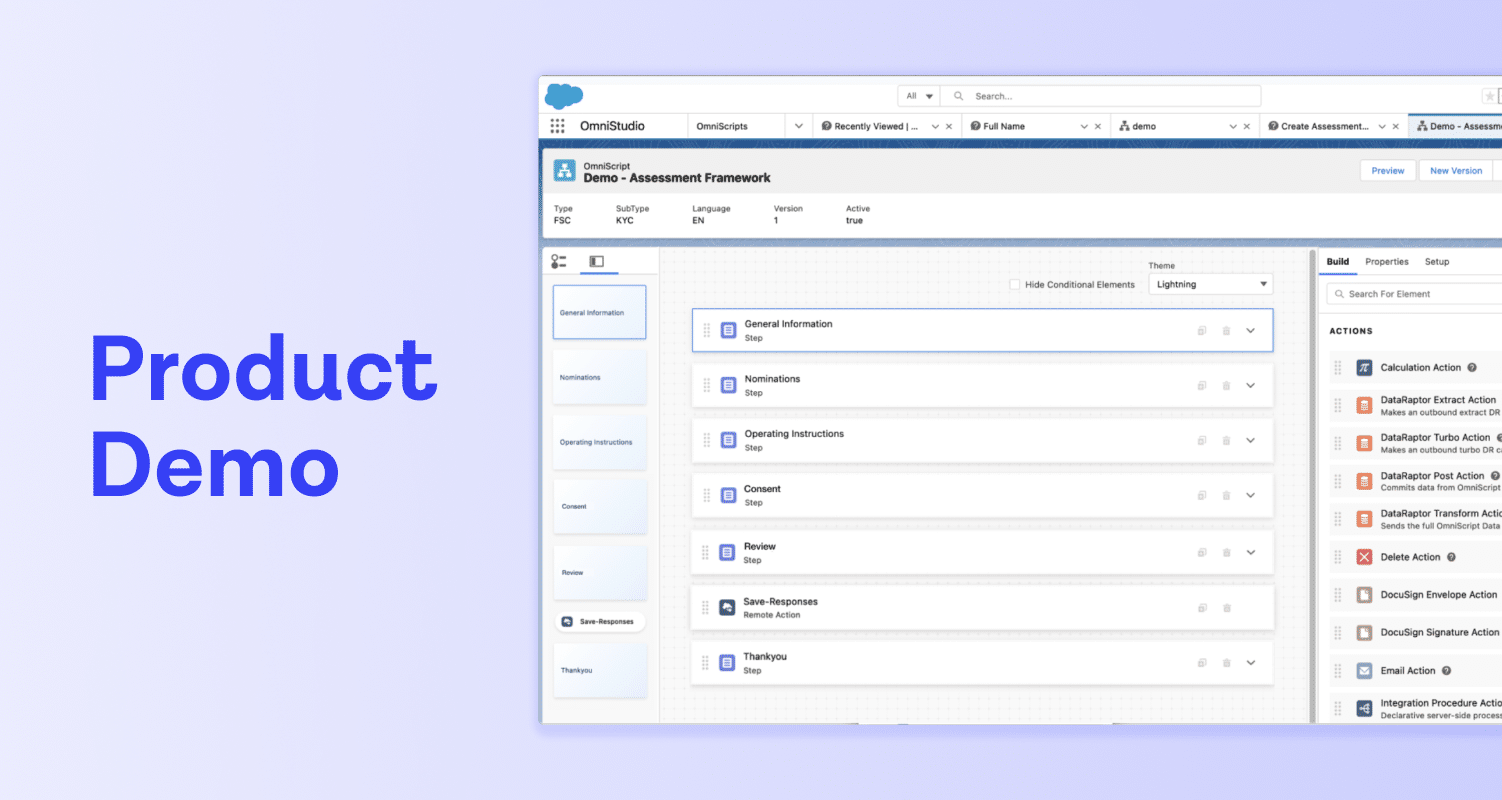

An example of fraud detection using machine learning is Onfido’s very own Atlas™ AI. Our AI was built using unique micro-model architecture, combining over 10,000 machine learning models to detect specific fraud markers.

Fraud detection AI offers several benefits over alternative approaches.

- Faster and more efficient: AI can comb through large amounts of data much faster than a human reviewer. This dramatically reduces manual review times and frees up operations teams to focus on more pressing tasks. AI can also operate 24/7, without needing to rest or take breaks, offering an around-the-clock way to detect fraud.

- More accurate: Machine learning can pinpoint minute details on documents that point to signs of fraud. The human eye is much more likely to miss these details. Plus the more data a machine-learning engine encounters the better it becomes at spotting fraud. So whereas large datasets would overwhelm a human reviewer, they actually improve machine learning systems.

- Cost-effective: As businesses grow and onboard more customers, this would put pressure on any teams that rely on manual verification alone. With fraud detection AI, businesses only need one solution to process the data. It allows businesses to scale without increasing risk management costs.

Step 3: Use a layered approach to detect fraud

Unfortunately, there is no one-size-fits-all approach to mitigating fraud. Fraudsters leverage different techniques to try and get around a business’s defenses. Putting different hurdles in place at different times will be one of the most effective ways to stop them.

However, these hurdles cannot impact the ‘good’ customer journey. The sign-up process still needs to be simple and efficient for genuine customers. Plus, different businesses have different risk appetites. No business is ever going to stop 100% of fraud — it’s an unrealistic goal. But some want to reduce the risks as much as possible, while others are more flexible. This is where a layered, step-up approach to detecting fraud comes in.

The four lines of defense are:

- Passive signals

- Document verification

- Biometric verification

- Post-onboarding

Passive signals

Passive signals run in the background during onboarding to evaluate Is this person a fraud risk? Because they are passive, they don’t rely on any input from the user themselves, so don’t add any friction for genuine users.

Passive fraud detection tools look at different signals from the user’s device, how that device interacts with the internet, operating system data, IP addresses and more. At Onfido, we piece all this information together to create a device intelligence report.

This is one way to help catch particular types of fraud. For example, if a user starts hundreds of identity verifications using the same unique device, this is highly suspicious and could indicate fraud ring activity.

Document Verification

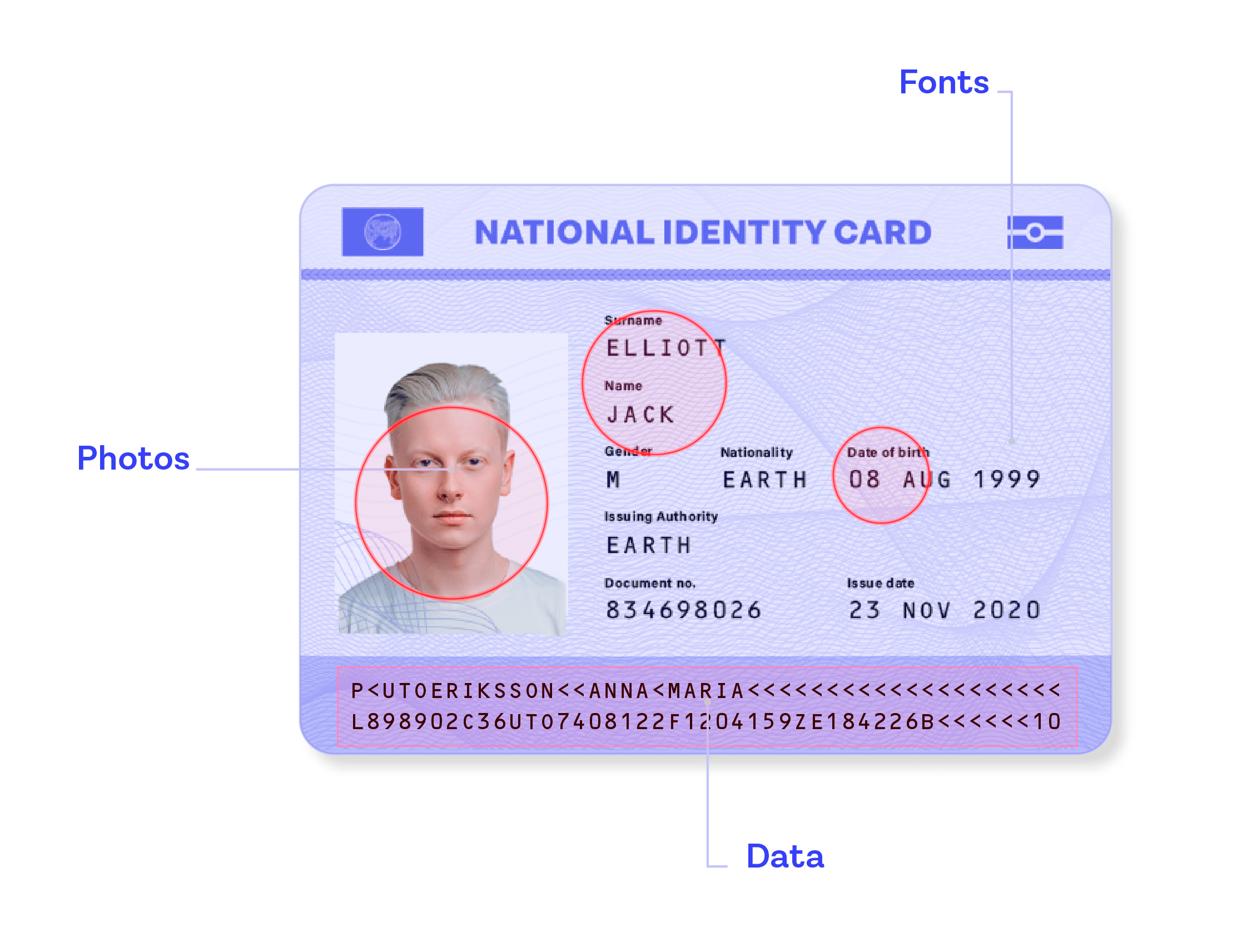

Document Verification assesses the authenticity of an identity document to determine Who is this person? Specialist AI can check for different anomalies across the document to help identify fraud.

- Data checks: Analyzing for data consistency, data validation, data comparison and repeat data.

- Visual checks: Every element of the document can present a possible sign of fraud. Onfido’s AI assesses the picture, fonts, shape, layout, and security features across the document.

Biometric Verification

Biometric Verification prevents stolen documents and determines, Is this a real person and are they who they say they are?

It detects things like photos of the identity document, photos of screens, printed photos, video playback, 2D and 3D masks, fake webcams, and emulators. Onfido’s Biometric Verification performs textural analysis and returns heatmaps to check for spoofs, and also looks at things like the metadata of any uploaded files to catch screenshots.

We offer four different types of biometric verification: Selfie, Video, Motion, and Known Faces (which looks for signs of repeat biometric fraud).

Post onboarding

Fraud doesn’t end once identity verification check is complete. There are measures businesses can take post-onboarding to help mitigate future fraud. For example, leveraging biometrics during a high-risk transaction to help identify signs of payment fraud.

So there you have it — three things to consider when building out more effective fraud defense.

- Put measures in place to detect fraud at that first point of interaction with a customer

- Leverage fraud detection software that uses AI and machine learning

- Take a layered, step-up approach to detecting fraud to balance security with UX

Download our Identity Fraud Report for the latest identity fraud threats and trends.