The rise in digital payment platforms and money transmitters has changed the way we interact with money on a daily basis. It’s become easier than ever for us all to send small amounts of money, very quickly.

This change has created great opportunities for businesses and consumers. We can now all make purchases online, often just a few, or even one click. But as with any area where there is opportunity, criminals are also taking advantage.

As transactions and payments have increasingly digitized, this has given rise to a type of money laundering known as micro laundering. Rather than risk detection by authorities, criminals are going under the radar by moving small amounts of money at a time, but via a large number of transactions.

What is micro laundering?

Micro laundering is a type of money laundering that involves much smaller transactions. Criminals follow the same three stages involved in money laundering — placement, layering and integration — but on a smaller scale, using microtransactions.

As financial institutions are facing ever-tighter money laundering controls, and are using more effective ways to identify fraud and money laundering, criminals have had to find new ways to launder money. Micro laundering is one approach they’re adopting.

As with any type of money laundering, criminals are able to ‘clean’ their funds and disguise the source. But as micro laundering involves small to medium transactions, it becomes much easier to avoid detection.

Financial institutions for example are only required to conduct due diligence on transactions over certain amounts, so small transactions fall under the radar of traditional AML checks. And as microtransactions aren’t subject to the same checks as large transactions, criminals are able to remain virtually anonymous.

Micro structuring money laundering

Micro laundering is also sometimes referred to as micro structuring. Whether you refer to it as micro laundering or micro structuring, the process is the same. It’s a method of money laundering where the perpetrator breaks down large transactions into smaller transactions to evade detection. For example, depositing multiple small sums of money into an account, before withdrawing them overseas.

Micro laundering definition: who is affected?

Criminals tend to target four different channels to conduct micro laundering.

-

Online payments and money transmitters

Online payment and money transmitter sites are vulnerable to micro laundering as these platforms were built to make small transactions easy and convenient. Criminals can make lots of small transactions via these sites which will eventually benefit themselves or an accomplice.

-

Online gaming

Online games often use credits that players exchange for real money. These platforms see large volumes of micro-transactions every single day. Bad actors can send virtual money which can then be turned into real money with far more anonymity than they might have via traditional channels.

-

Cryptocurrency

Many digital currency platforms allow users to convert money to digital currencies such as Bitcoin. Cryptocurrencies can offer a high degree of anonymity, and while this offers some benefits, also makes it a very appealing route for micro laundering.You can read more about what’s next for crypto KYC in our blog.

-

Job advertising sites

Criminals can use freelance job sites to conceal laundered funds via money mule systems. They can post a job request via one account, and then sign up for the job via a different account. This way when the payment is made, they’ve ‘cleaned’ the funds that were sent via that transaction and it will look like the funds have come from a legitimate source.

The impact of micro laundering

First and foremost, micro laundering is a compliance issue. If businesses fail to comply with AML regulations, or aren’t conducting the necessary levels of customer due diligence, they can face heavy AML fines and penalties.

With micro laundering more likely to go undetected by traditional methods of AML and due diligence checks, we could start to see stricter processes and greater use of technology as businesses look to other ways to combat the issue.

Secondary to the compliance issue, micro laundering also has the potential to damage a business’s reputation, which in turn affects users’ trust in that brand.

How to spot micro laundering

Unfortunately, micro laundering is something that’s incredibly difficult to detect. While digital payment systems have made it easier than ever to make fast, seamless transactions for everyone on a daily basis, they’ve also become a tool for the cybercrime economy.

There are some signs that businesses can look for which are indicators of micro laundering, for example:

-

Rapid movements of small transactions via money transmitters or payment platforms

-

Large numbers of small-dollar purchases to isolated groups of online merchants

-

Transactions via money transmitters or payment platforms being the only activity in an individual account for an extended period of time

But these signs alone aren’t enough to catch all instances of micro laundering. The challenge remains, how do businesses identify the minority that are finding holes in anti-money laundering (AML) defenses.

It’s becoming more important than ever for businesses to turn to multiple signals and indicators, such as IP addresses, relating to an individual’s purchasing or transaction behavior online.

What’s the difference between micro laundering and money laundering?

Money laundering is how criminals hide funds from illegitimate sources, but on a much larger scale than micro laundering. While micro laundering is still a challenge for businesses to detect, there are much more concrete measures in place to prevent traditional money laundering.

To help prevent money laundering, businesses should put in place the following steps:

-

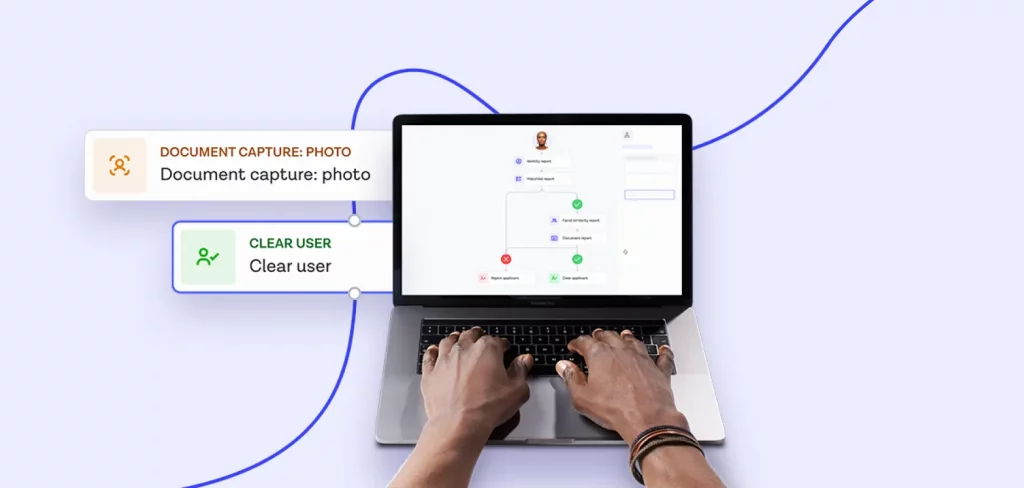

Implement Know Your Customer processes. Preventing money laundering starts with knowing the identities of your customers via identity verification. This step includes validating customers’ personal information such as proof of address.

-

Conduct customer due diligence. Most customers will only require standard CDD checks, but higher-risk customers require enhanced due diligence (EDD). Find out more about the difference between CDD and EDD.

-

Maintain up-to-date records for high-risk customers.

-

Monitor accounts for suspicious activity and report suspicious activity to authorities.

Find out more about how we could help your business meet AML requirements.