On Wednesday 1 February, HM Treasury published a consultation on the ‘Future Financial Services Regime for Cryptoassets’. The announcement comes fresh in the wake of the recent high-profile collapse of FTX in November 2022 — once valued by investors at over $25 billion, FTX is now valued at $0. While the existing Financial Services & Markets Bill is already moving to regulate certain types of crypto (UK stablecoins), recent failures and ongoing turbulence in the crypto markets have reinforced the move to establish a clear regulatory framework for cryptocurrency in the UK. The new proposals aim to enable crypto firms to innovate, while improving financial stability and consumer protections.

Cryptocurrency regulation in the UK — what’s expected?

Currently, all UK-based crypto firms that provide exchange or custodian services (i.e. wallets) must comply with the Money Laundering Regulations 2019 (MLRs) in order to provide regulated services. UK crypto regulation would be overseen by the Financial Conduct Authority or FCA, crypto being classed as a financial service. This enables the FCA to check that UK cryptocurrency firms have effective anti-money laundering and KYC processes in place.

However, there are currently only 40 or so FCA-registered crypto providers — with Bitpanda, Gemini, and Kraken being the biggest brands. Many of the world’s largest exchanges and wallets are operating offshore, meaning they are not obliged to comply with the UK MLRs and perform comprehensive KYC/AML procedures.

The latest proposals would extend the geographical reach of these obligations. They will apply to all "cryptoasset activities provided in or to the UK", meaning that...

- UK firms providing services to consumers in the UK or overseas

- Offshore firms providing services to UK consumers

…will both have to comply with UK anti-money laundering regulation. There is likely to be an exception for reverse solicitation, for example, if a consumer (of their own volition) reaches out to a non-UK based crypto exchange. However this is likely to be limited as the new financial promotions regime would restrict the ability of non-FCA registered crypto exchanges to market and advertise their services to UK crypto consumers.

Additionally, crypto exchanges would have to adhere to new market abuse regulations regardless of the location of the market abuse activity (which could take place within the UK or overseas). This would place an additional onus upon exchanges to establish “who” offenders are in order to have an effective regime for disrupting their activity. Indicatively, this could include KYC requirements, public blacklists, order book surveillance, suspicious transaction and order reports (STORs), and information sharing between trading venues.

Complying with UK crypto regulation: how can Onfido help?

To comply with the new regulations, many more exchanges and wallets (based both in the UK and offshore) would have to incorporate RegTech solutions for KYC/AML checks to screen against lists of sanctioned and politically exposed persons (PEPs), and utilise document and biometric verification to securely verify personal information as part of a customer due diligence programme that satisfies AML reporting rules. Although some will already have systems in place, the FCA has recently stated that 85% of firms applying to the UK’s crypto register have failed to meet the minimum KYC/AML standards. At Onfido, we work with hundreds of cryptocurrency businesses globally to conduct identity verification that allows them to stay compliant and stop fraud, while enabling growth.

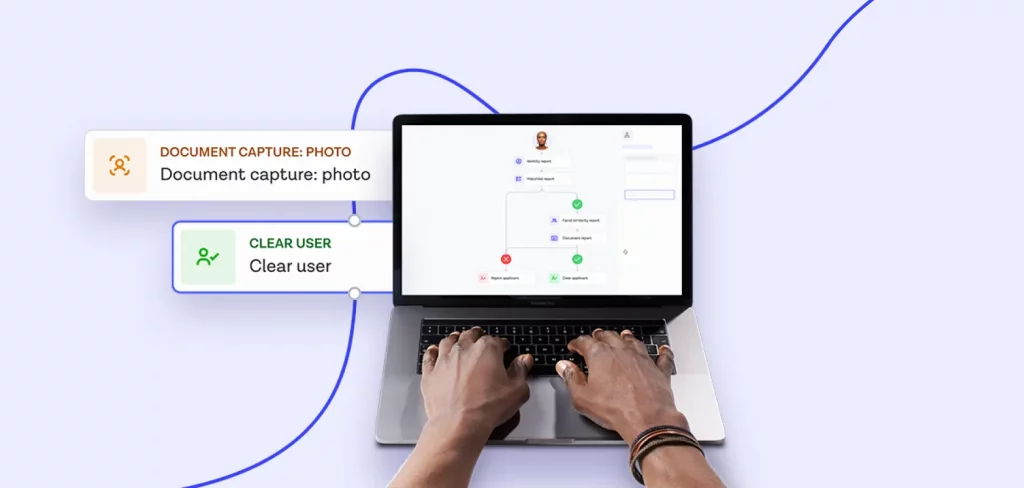

Our platform allows exchanges to build identity verification workflows tailored to the needs of individual markets — all in a drag-and-drop interface.

Our interactive tour walks through our Verification Suite, award-winning AI, and drag-and-drop workflow builder — Onfido Studio.