Batman & Robin. Peanut butter & jelly. Financial services and… compliance. Some things are just made for each other. In Europe, the financial services compliance landscape is evolving every day as KYC / AML regulation matures to meet the demands of an increasingly digital and interconnected world.

On the one hand, the cost of non-compliance has never been greater for financial services; according to the Liminal Link™ Index: Account Opening in Financial Services, global AML fines increased by over 50% in 2022 to $5 billion. At the same time, the regulatory landscape is shifting. In the EU, different member states are applying KYC/ AML directives in different ways — across ‘standards bodies,’ such as The European Telecommunications Standards Institute (ETSI), responsible for prescribing pan-European technical standards for identity verification, through to ‘guidance bodies’ such as the European Banking Authority (EBA), who provide guidelines on the appropriate solutions for verifying a customer remotely.

Rapid evolution of the landscape now has the unfortunate side effect of becoming increasingly fragmented, with consequences for both businesses and their customers. For financial services providers to scale, they must build experiences that cater to the local KYC/ AML requirements in every market they operate within. This often means a patchwork of solutions and workflows – which then has knock-on effects on their customers, who simply demand smoother onboarding experiences.

At Onfido, we’re making local compliance simpler for businesses globally. We’ve built the Onfido Compliance Suite to give you the tools you need to build tailored identity verification processes — orchestrating our suite of verifications with flexible, no-code workflows.

Here are some examples of how financial services can use Onfido to address EU KYC & AML compliance.

See the user experience of document and biometric verification, QES signing and OTP authentication in our Smart Capture SDK.

Build KYC & AML policies to address ETSI, EBA guidelines, and more, seamlessly

When it comes to building KYC & AML policies at onboarding, financial services today must carefully manage the process step by step, from investigating compliance requirements in their local market, through to assessing and procuring the relevant identity signals, to finally integrating and building these identity signals into the onboarding experience.

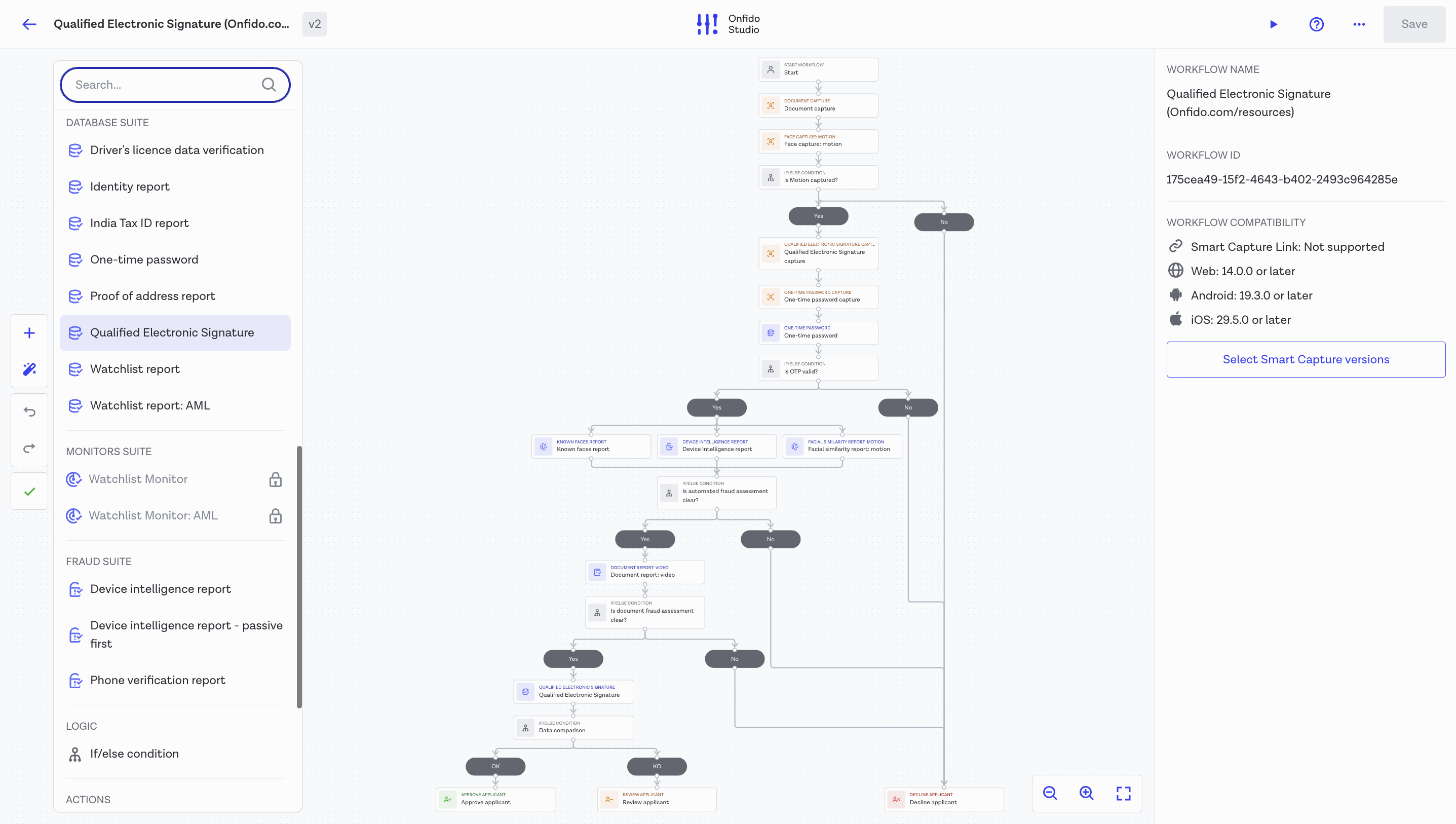

Let’s take a look at a bank onboarding customers in France. In line with the European banking Association (EBA) guidelines, the Autorité de contrôle prudentiel et de résolution (ACPR) highlights a number of options for compliant customer onboarding, including a combination of the following:

- Document verification

- Biometric verification

- One-time password

- Device Intelligence

- Qualified electronic signature

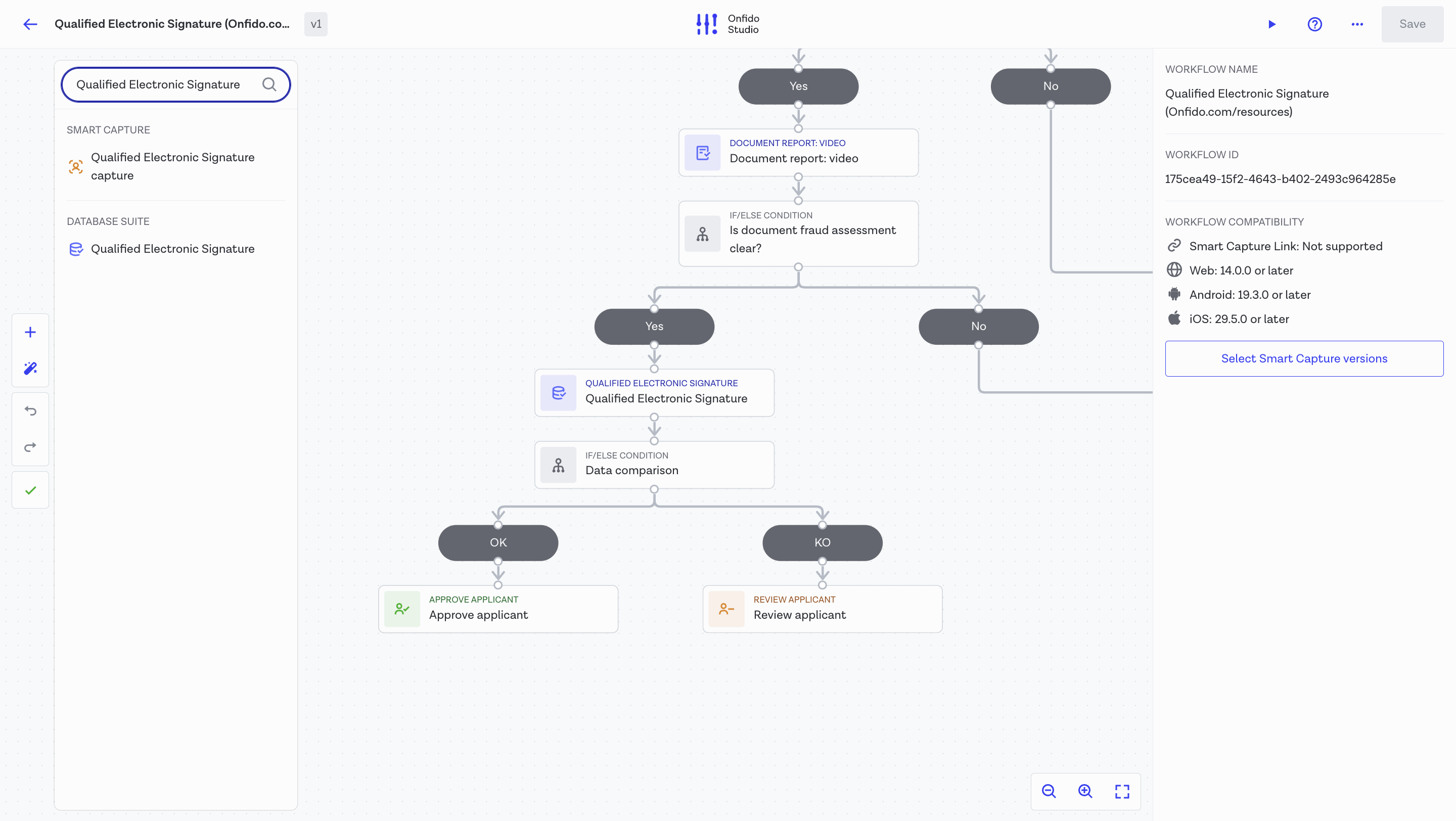

Now, turning these requirements from written-down policy to real-world verification process is a simple case of dragging and dropping in Onfido Studio, our flexible no-code workflow builder. You can pull from Onfido’s curated library of verification methods, including ETSI-certified identity verification, and trigger them in the preferred order for your business needs. Want to review edge cases manually? Send these to your team with a simple if-this-then-that condition. Want more control over which fraud assessments automatically reject users? It’s all in your hands.

For our French bank, they need to perform a qualified electronic signature in addition to the ETSI-certified identity verification. Building this policy within Onfido Studio is as simple as clicking ➕ and searching for “Qualified Electronic Signature.” From there, drag it into your flow and deploy in minutes, giving you confidence that you’re addressing regulatory needs such as the EBA guidelines at your customer onboarding.

Maximize user approvals with a compliant IDV experience built for your local markets

If you’re operating in multiple regions, or have aspirations to expand into different markets, a one-size-fits-all approach doesn’t work for you or your customers. Let’s say our bank wants to expand from France to Romania — they will face different regulatory approaches to remote identity verification compared with France, despite them both being in the EU. In this case, how do you satisfy the stricter French compliance checks without driving away your users in Romania?

No problem. Build bespoke experiences for each market you care about, without the headache. For our bank, their users in Romania are not required to perform a qualified electronic signature check, although ETSI-certified identity verification is still mandated. In this case, the bank can simply introduce a new condition to route their customers based on, for example, geo-location. Under this new condition, Romanian customers will skip the QES step altogether, without the need to build an entirely new onboarding experience. Plus, Onfido accepts and verifies documents globally, giving our bank the best possible local onboarding, wherever they operate.

Unsure which regulations and guidelines impact KYC in Europe? Check out Onfido’s guide to EU KYC & AML to get you started.

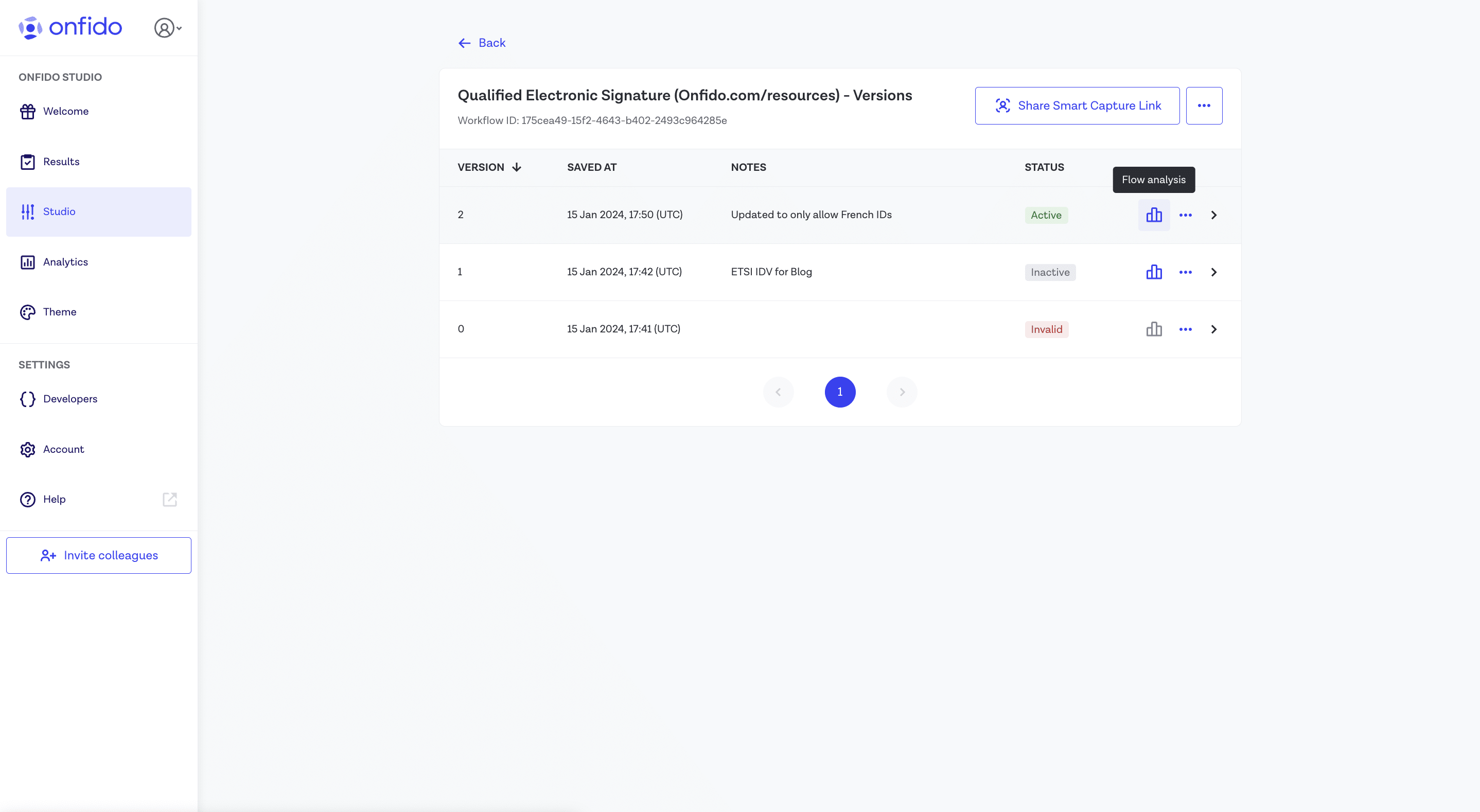

Optimize the experience and introduce changes, with no code

Building a compliant workflow, whether it’s ETSI-compliant, in line with EBA guidelines, or tuned to your business’s unique needs, is just the beginning. In the example of our French bank, building the ideal onboarding experience is a balancing act between Compliance & Risk teams, Product teams, and Growth teams. With Onfido Studio, you can optimize your workflows with no code, and view in-depth analytics across pass rates and suspected fraud, to help you plan for the future.

Address ETSI standards, EBA guidelines, and more with the Onfido Compliance Suite

Today, customers like Lemonway and TBI Bank are using Onfido to build a simpler, smarter approach to identity verification in their local markets, while enjoying global coverage across document, biometric, and data verification methods. See how you can meet complex local regulatory needs while onboarding more customers with Onfido’s off-the-shelf Compliance Suite.