AI-powered KYC for Canada

Navigate KYC compliance in an end-to-end platform. The Real Identity Platform enables FINTRAC compliance, allowing businesses operating in Canada to digitize identity verification and deliver exceptional onboarding experiences.

How can Onfido help?

Onfido set the gold standard in terms of client onboarding. Acting as a true partner, we felt supported with best practices and knowledge-sharing. As part of our ongoing efforts to improve conversion and customer experience, Onfido has collaborated closely with us to optimize our performance. Whether it’s their developers or UX Design experts, they have been open and accessible.

Peter Lu, Credit & Lending Product Lead, KOHO

Read the case studyWhat are KYC regulations in Canada?

The Proceeds of Crime (Money Laundering) and Terrorist Financing Act of 2001 (PCMLTFA) primarily applies to financial services businesses, with the aim of combating money laundering and terrorist financing. Compliance is managed by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). It outlines the methods that regulated businesses can use to verify the identity of their customers.

How can Canadian businesses verify identity?

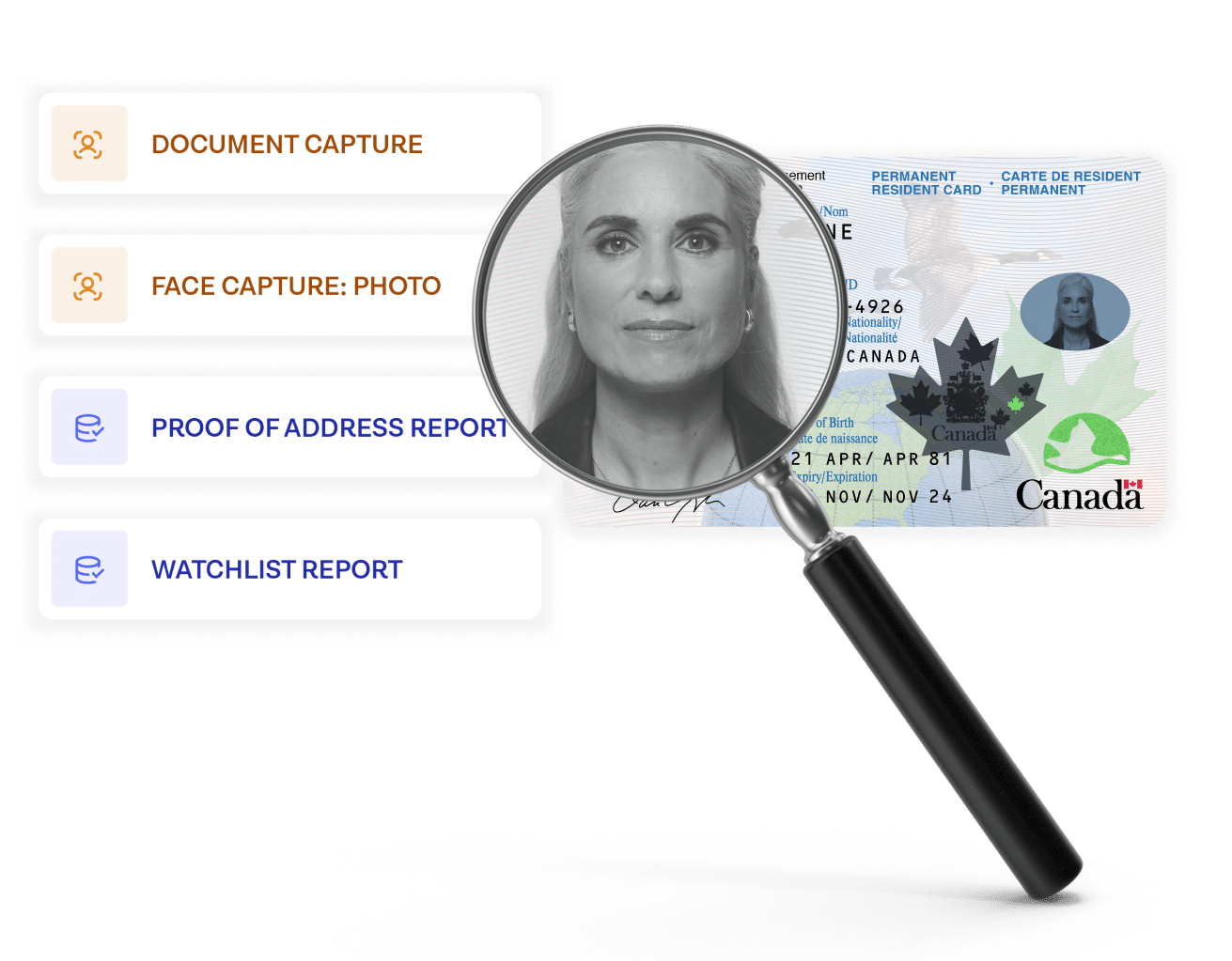

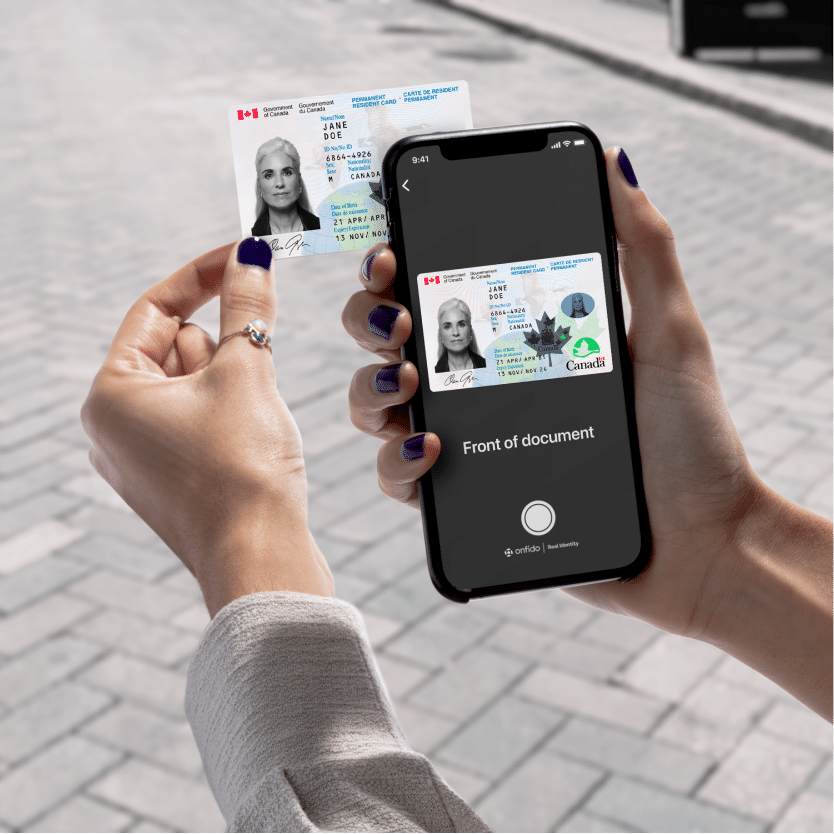

PCMLTFA regulation allows for a number of remote identity verification methods. Users can scan their government ID using a smartphone or electronic device to be analyzed for authenticity, and also take a selfie photo — to be matched against the photo on their ID. So customers can sign-up for financial services in seconds from anywhere.

How does Onfido help?

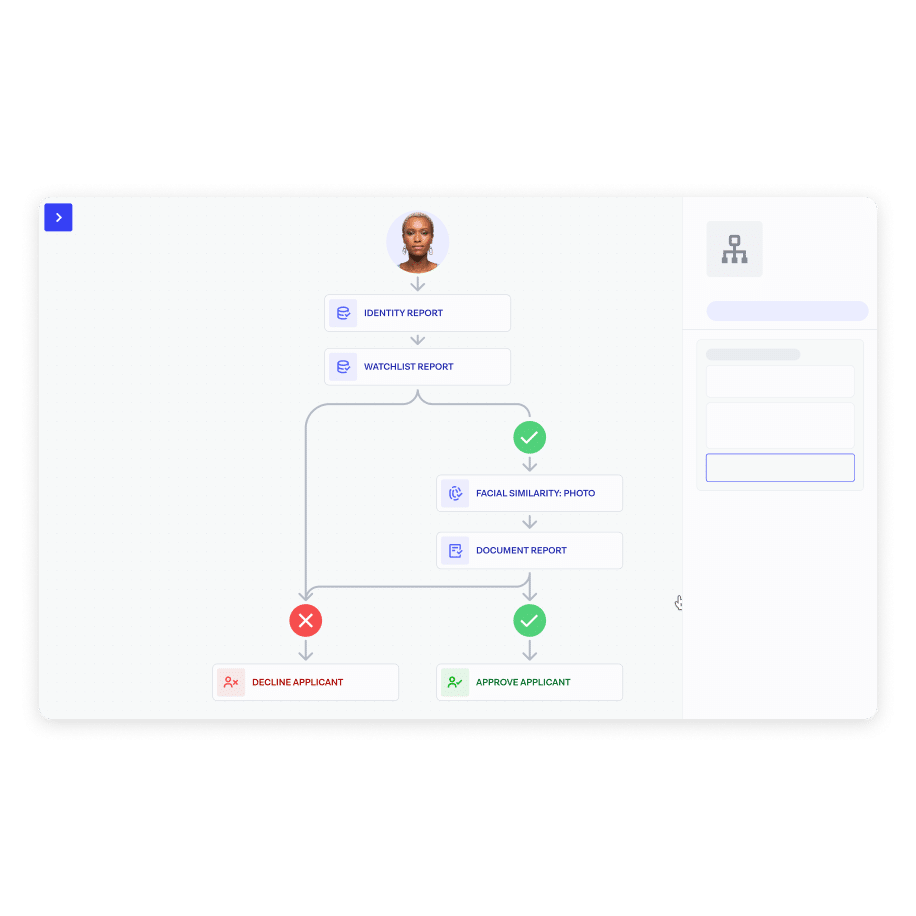

Our AI-powered solution enables the capture of ID documents and facial biometrics, giving businesses confidence in the identity of their users. You can build flexible no-code workflows in Onfido Studio to automate the decision-making process for specific regulatory obligations. We return results in seconds via API or our dashboard.

Identity verification solutions for Canada

Document and Biometric Verification

Have confidence in your customer’s identity by verifying supported Canadian-issued photo IDs such as a driver’s licence, passport, residence permit, service ID, and indigenous card. Powered by Atlas™ AI, our Onfido document verification uses advanced techniques to assess documents for authenticity.

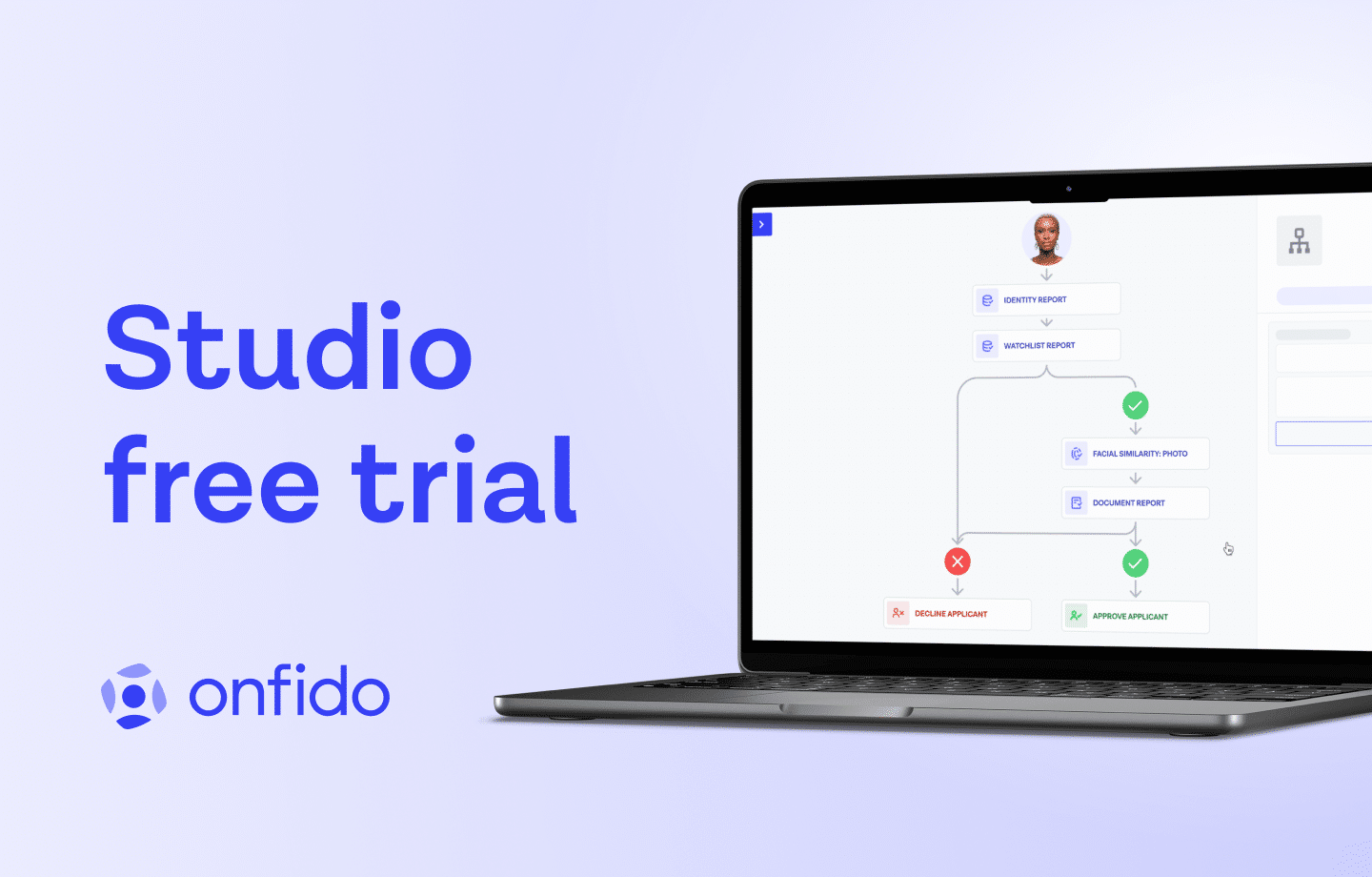

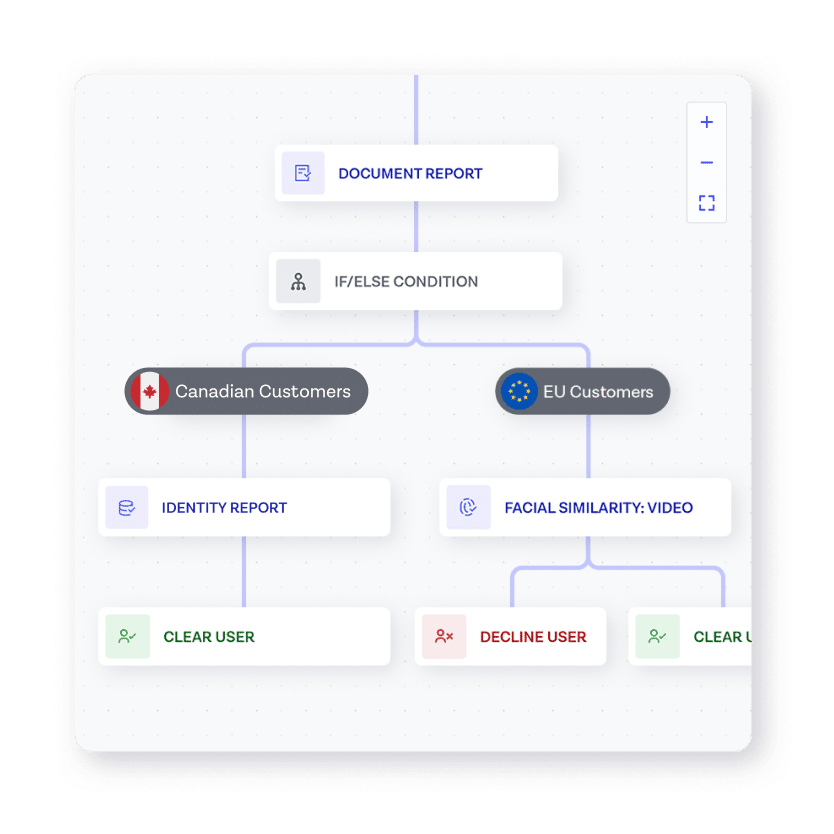

Onfido Studio

Build identity verification workflows according to your needs in our drag-and-drop orchestration tool. Users are automatically routed to the path that makes the most sense for them to maximize conversion and minimize risk.

Smart Capture

Make document and biometric capture seamless with our Smart Capture SDKs. They feature glare and blur detection, multi-frame image capture, and WCAG AA accessibility features.

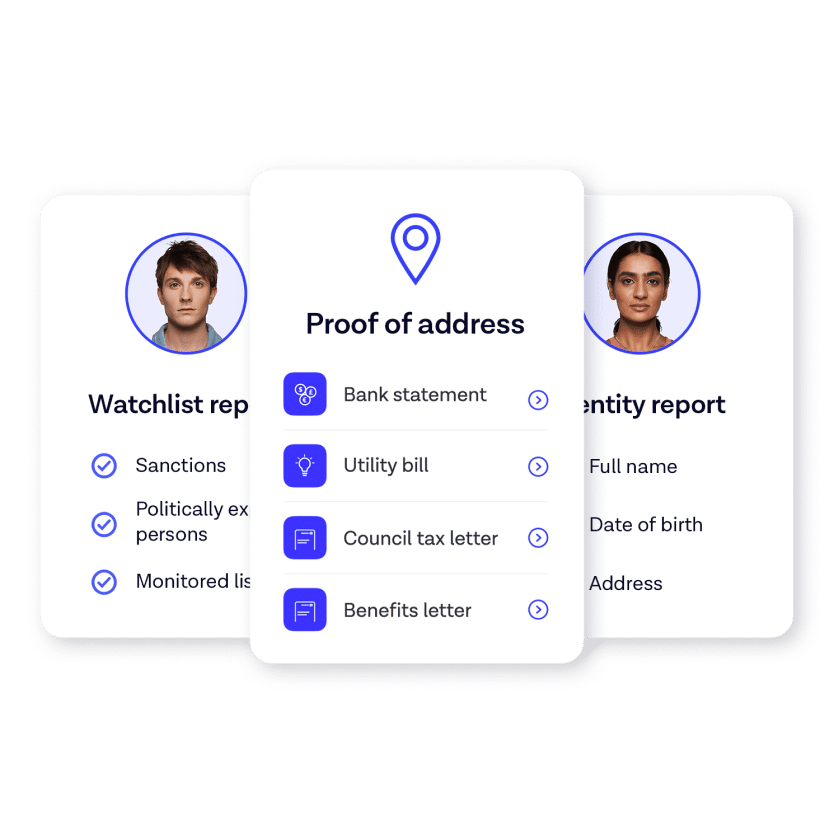

Data Verification

Validate user-submitted data against a range of trusted data sources globally and locally. Choose a range of database verification methods including Identity Record, PEPs and Sanctions Watchlists, and more.

Fraud Detection Signals

Analyze passive fraud signals like phone and device intelligence to catch organized fraud without introducing additional user friction.